Welcome to issue number two!

For our inaugural newsletter, we wrote on Returning to Work, the Evolving Office, and some Market Optimism. In short, the overall momentum for companies returning to the office is positive. It goes without saying that the pandemic has significantly changed the way in which companies work, but the days of taking zoom calls in sweats are coming to an end; unplanned office run-ins, in-person collaboration, and after-work drinks are coming back. With fall on the horizon, many companies are still figuring out 1) how to best bring their employees back to the office (whether through a hybrid model, 5 days a week in the office, etc.) and 2) how they can encourage people to come to the office. Given the uncertainty and need for increased flexibility, many companies are utilizing flexible space providers.

While flex space providers took a hit during the pandemic, we are seeing a larger demand now more than ever:

Post-COVID, not only are we seeing the return of small and medium sized tenants to flex space, the traditional tenants of coworking spaces according to the International Workplace Group (IWG , but as the workspace is reevaluated, and a ‘new normal’ sets in, large companies are beginning to utilize these spaces as lifelines too.

As demand for flex space climbs, landlords are catching on. In May, Tishman Speyer announced that they will bring its own coworking brand, Studio, to a former WeWork space at 175 Varick Street. They are also opening at 11 West 42nd Street, growing Studio’s footprint in Manhattan to 350,000 SF.

According to the results of a recent survey from essensys and compiled by Verdantix, tenants want services, amenities, tech-enabled workspaces and a network of locations. Jeremy Bernard, CEO, North America, at essenys calls all of these features critical. “It’s about providing trust and confidence in the return to the office for the immediate future,” adds Bernard. “But landlords need to position their portfolio now for the long-term to continue serving their tenants’ evolving real estate needs. It’s the only way they can stay relevant and drive revenues.” He also notes higher quality technology and security as a driver for flexible space. The report found that 67% of occupiers are not fully satisfied with the data security in flexible spaces, but only 47% of landlords see higher quality technology as a driver of flexible space offerings.

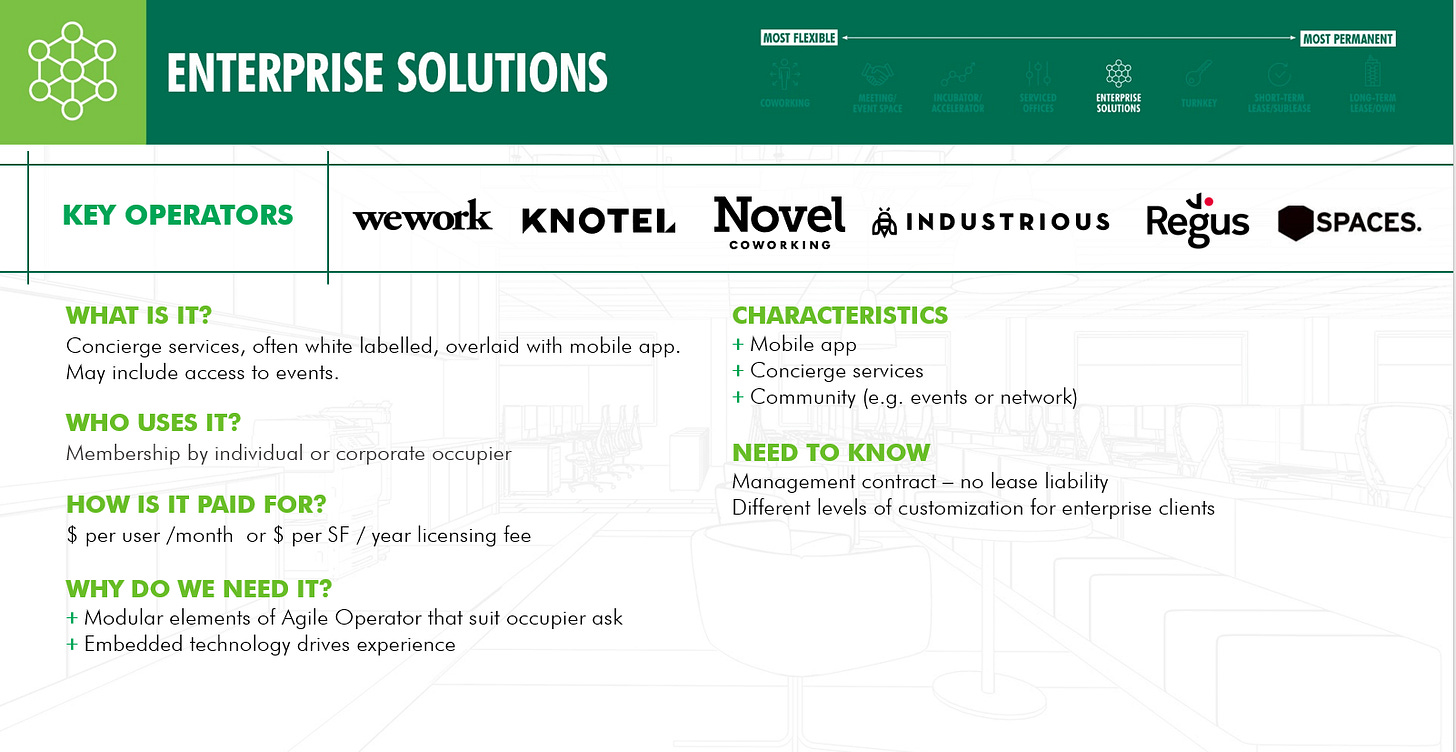

A weakness that has often been associated with flex space is the lack of tenant identity and branding. Industrious, who recently joined Propmodo on the webinar “How Office Building Owners Can Use Tech to Prepare for the Flex Work Revolution,” is adapting its model to integrate a personalized feel for its tenants.

Below we have summarized some recent articles covering flex space.

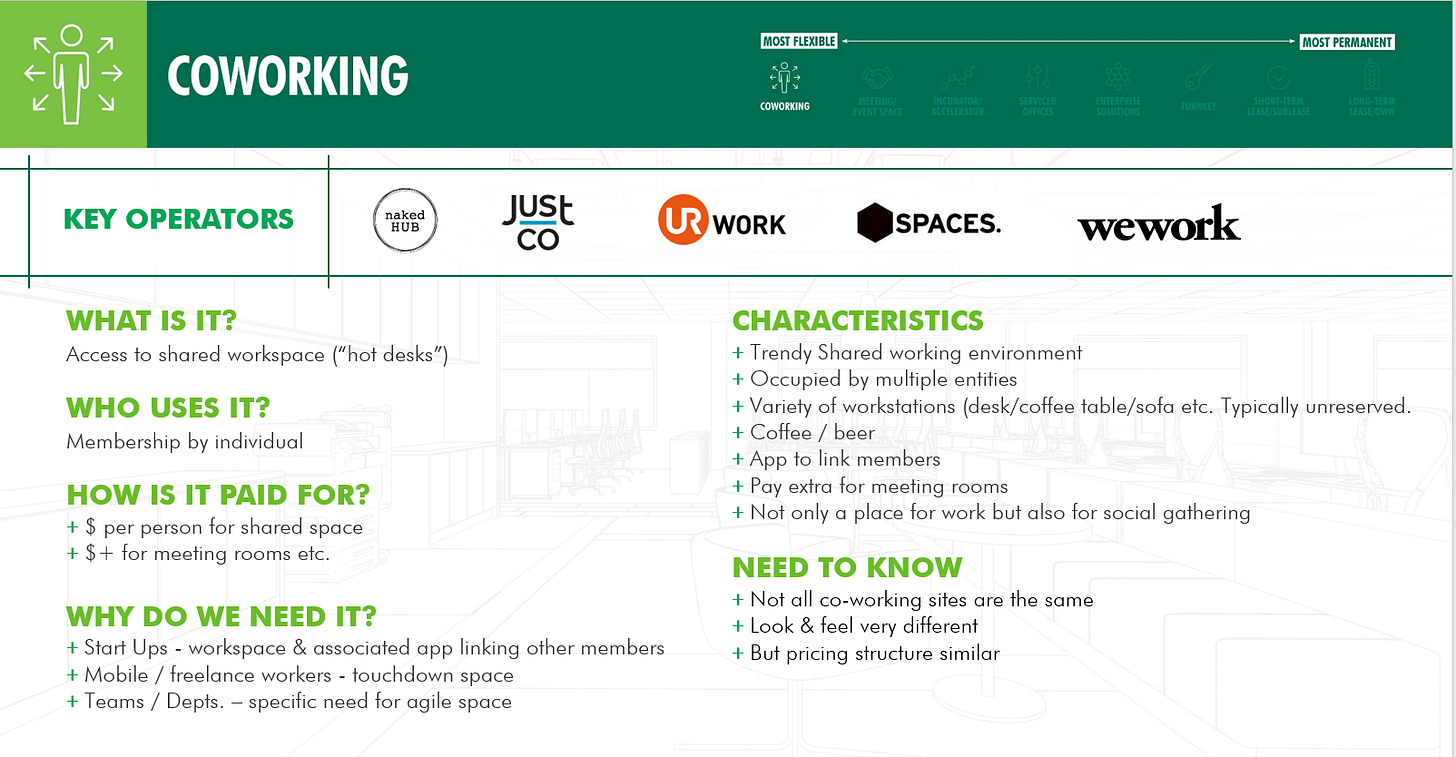

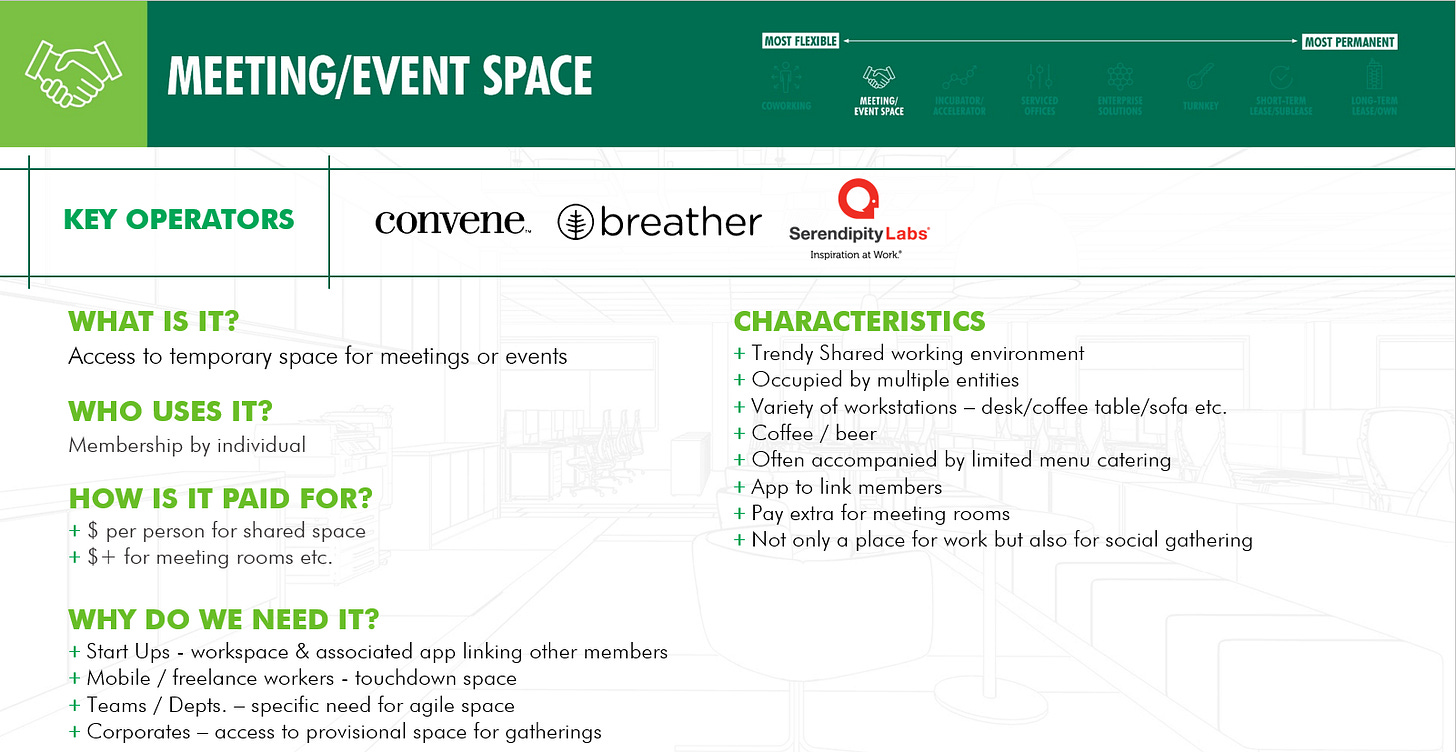

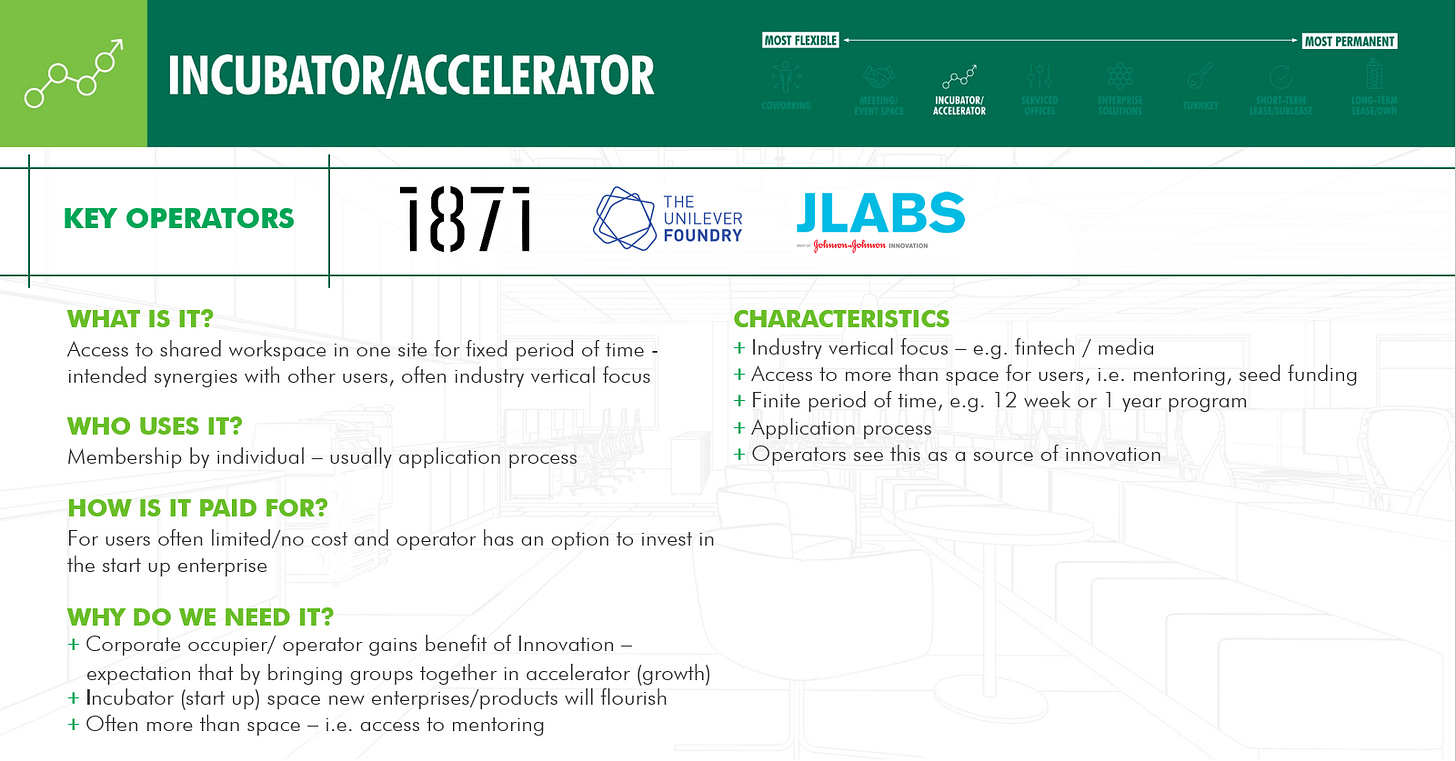

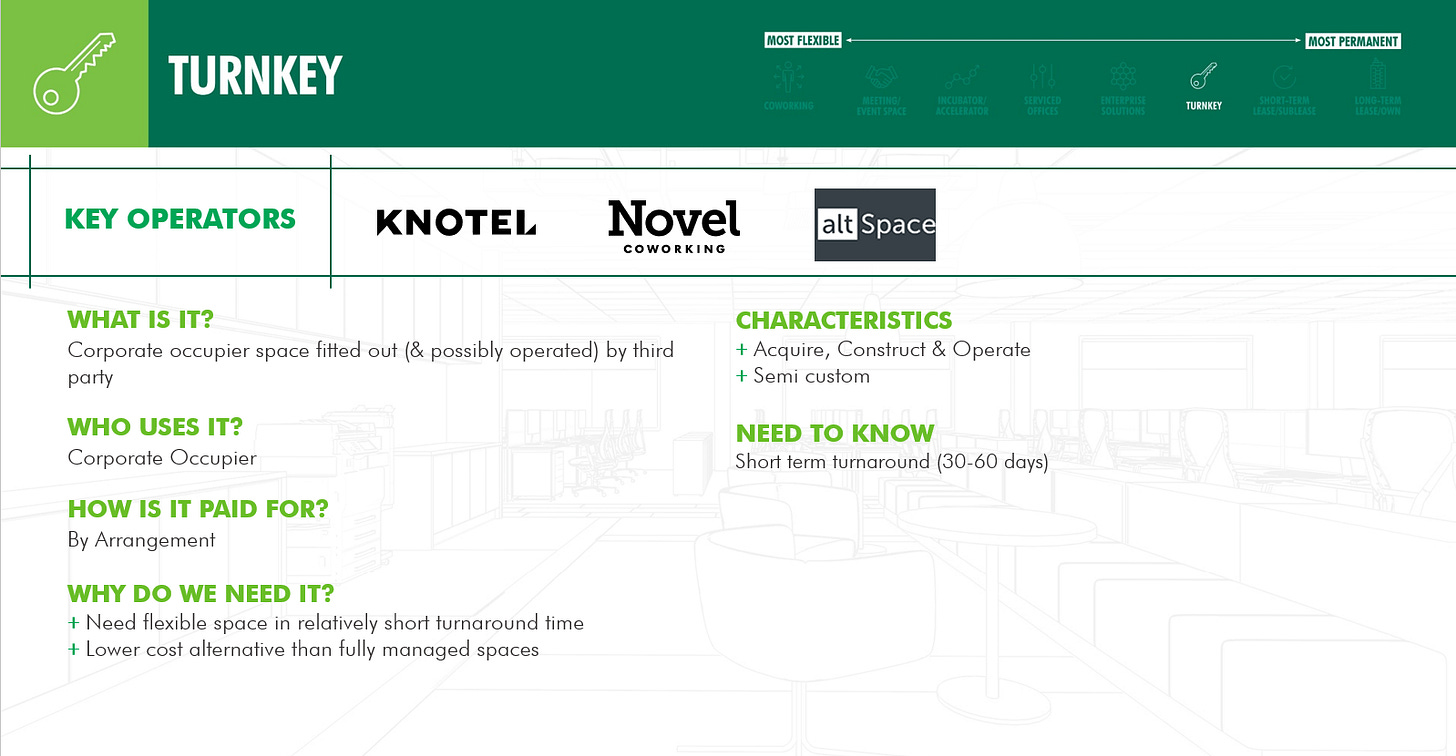

Finally, for those less familiar with the world of flex space, we have illustrated the spectrum of flex space from coworking spaces to turnkey spaces that will familiarize you with the top companies, advantages, and the quick facts.

Please share with those who may find this useful!

How Should Flexible Buildings Adapt Technologically for the New World of Work

The pandemic accelerated the demand for flexible buildings, but this means that there is a new requirement to develop smart buildings according to Manish Kumar. He believes that it is essential to flexible space to be able to generate environmental and occupancy data that will inform more effective corporate real estate decision-making. Essentially, the answer to keeping up with the dynamic and fluid conditions of at-home/in-person work is flexible buildings that are capable of using data analytics to enable “dynamic stacking” of office floors as attendance fluctuates. This technology will allow the buildings and building managers to better accommodate for the changing attendance. Kumar says that people need to feel in control of their environment, and when unexpected changes happen in the workspace, it is easy to find oneself in a space that feels overcrowded. With an open, integrated building management system, buildings can evolve with their workforce and optimize productivity while encouraging workers to come into the office.

Commercial Property Executive – 7.26.21

By Manish Kumar

How are Big Companies Using Flexspace?

Why are large companies starting to make the shift towards flexspace and when did this trend start? Spaceworks analyzes a few companies that signed deals before the pandemic hit (namely Standard Chartered Bank and Japanese telecommunications company NTT) and how they first re-evaluated their office needs. IWG, Spaces’ parent company, CEO Mark Dixon believes that a more flexible approach will be appreciated by their employees, as flexibility is almost like the new signing bonus. He continues to say that commuting times are inefficient, and as companies start to realize that there will be less turnover for talent. This will lead to long-lasting use of shared spaces as their market grows in size.

Spaces – 4.26.21

By Spaces admin

CBRE The Weekly Take Episode 228;

Lean on Me: The Role Flexible Workspaces Play in New Work Arrangements

Listen to CBRE’s podcast, The Weekly Take, where this week they discuss at length the rising interest in flexible workspaces along with the many factors. Host Spencer Levy is joined by Jamie Hodari, CEO and co-founder of Industrious, and CBRE’s Christelle Bron to discuss how coworking spaces are allowing companies to better manage their real estate and accommodate employee preferences for more flexibility at work.

Cutting to the chase, in an increasingly hybrid world, Christelle is optimistic about its growth. One of the main differences in her mind between what flexspace has been traditionally and what they will be in five to ten years is that it used to be very B2B business and directed towards tech companies, startups, and hyper-scaling companies. Now, it has opened up to more mainstream companies: pharma, financial services, and more traditional services that were slow on the embrace initially. In the next five to ten years, she thinks that a hypothetical 20% of the portfolio should be flex or agile. Secondly, she believes that in five to years the next frontier will be marrying physical space with social networking and making it one place. Essentially, in some ways it will be like the Airbnb of the office.

Jamie is a bit more hesitant to say where we will be in five years, placing the onus in the hands of employees and employers to go to the office and collect data, respectively. This will form a ceiling for each industry. Overall, he predicts the industry will grow but it is impossible to say how much.

CBRE; The Weekly Take - 7.26.21

By Spencer Levy, Jamie Hodari & Christelle Bron

There are a lot of different flexspace offices. What are the differences and who are the major players in each section?

Here are some helpful CBRE slides to offer clarification

Check out our Real Estate Views and News webpage and feel free to contact our CBRE team directly @

Taylor Callaghan, Senior Vice President

taylor.callaghan@cbre.com | 212 984 8272

Nicole Marshall, Associate

nicole.marshall@cbre.com | 212 984 6593

Graham Walter, Associate

graham.walter@cbre.com | 212 984 8059

Have any thoughts you want to share?

Lastly, check out the full CBRE “the Weekly Take” podcast with over 250k listens from investors and occupiers with features from everyone from Darcy Stacom on advising clients amid the COVID crisis to the Economic Outlook for a New Year and New Administration.